What you need to know

- Banks are keen to see Apple receive less of a cut for transactions that are recurring, like subscriptions.

- Visa had previously made plans to change how things work, but those plans now seem to be shelved.

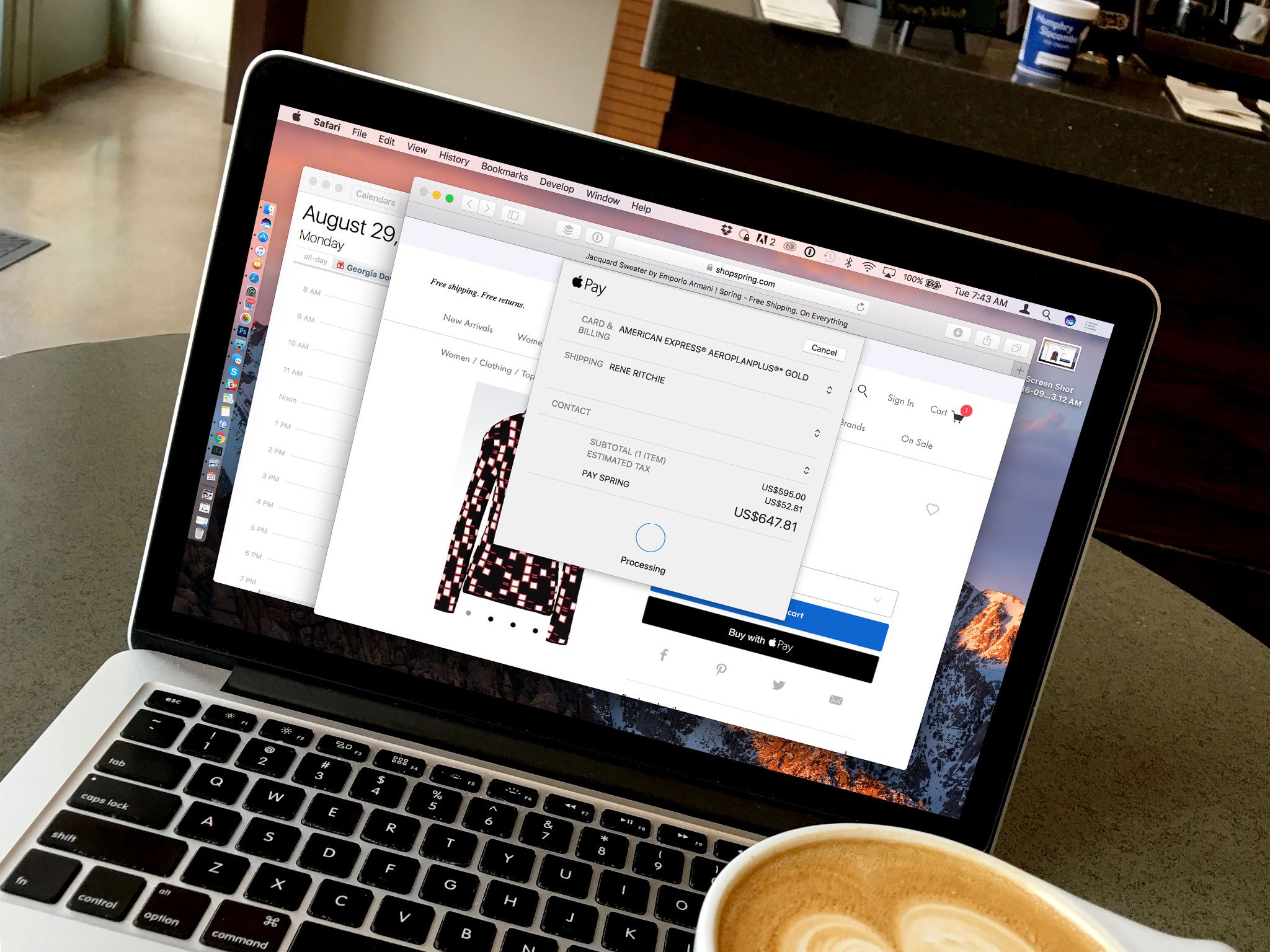

Visa and Apple are reportedly in talks about how recurring payments are handled.

Banks are keen to see the amount of money Apple receives for Apple Pay transactions cut, although the main discussions revolve around recurring payments for subscriptions of all types.

According to a report by The Wall Street Journal, Apple Pay transactions see banks hand over 0.15% of each purchase made by their credit cardholders. Those fees are the issue, with Visa proposing that Apple receives a transaction fee on the initial payment and not every payment that goes through after that — effectively cutting it out of the system entirely for the life of that subscription.

Visa shared its planned technical change with at least some banks in recent months. A document reviewed by the Journal that explained the new process didn't mention the fees but detailed a change to so-called tokens that Visa issues for mobile-wallet payments.

When consumers load their credit card onto Apple Pay, Visa issues a special token that replaces the card number. That allows the card to work on Apple Pay and also helps keep the card secure in a potential data breach, among other benefits.

Visa plans to start using a different token on recurring automated payments. That effectively means that after a first payment is made on a subscription, Apple won't get fees on the following transactions.

Apple, perhaps predictably, isn't a fan of that. Especially considering the fact "those fees account for most of the revenue that Apple makes from its digital wallet." Both Visa and Apple are said to be in discussions to work out where to go from here, although it's possible the change will be made regardless.

This is all made more complicated by Apple Card, a partnership between Apple and Goldman Sachs that saw a Visa-branded Apple credit card launch. Apple has previously agreed not to get into the payment handling business to compete with the likes of Visa before, something it has so far stuck to. Visa will no doubt want to ensure that the status quo remains, at least in that regard.

0 Commentaires